The easiest way to take advantage of compound interest is to start saving! For longer-term savings, there are better places than savings accounts to store your money, including Roth or traditional IRAs and CDs. If you left your money in that account for another year, you’ll earn $538.96 in interest in year two, for a total of $1,051.63 in interest over two years. You earn more in the second year because interest is calculated on the initial deposit plus the interest you earned in the first year. When interest compounding takes place, the effective annual rate becomes higher than the nominal annual interest rate. The more times theinterest is compounded within the year, the higher the effective annual interest rate will be.

You’re our first priority.Every time.

If you’re an investor on a fixed income, you’ll likely take regular withdrawals from your account. To calculate compound interest with complete accuracy, enter the amount you will withdraw from the account and at what frequency. If you don’t plan to make withdrawals from the account, just leave this at zero. Assuming you added no more money into the account, you’ll do slightly better holding a bond that accrues compound interest after just one year.

Total Balance

The interest rates of savings accounts and Certificate of Deposits (CD) tend to compound annually. Mortgage loans, home equity loans, and credit card accounts usually compound monthly. Also, an interest rate compounded more frequently tends to appear lower. For this reason, lenders often like to present interest rates compounded monthly instead of annually. For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

Compound Interest: Start Saving Early

This allows small amounts of money to turn into massive sums over time. You may also be interested in the credit card payoff calculator, which allows you to estimate how long it will take until you are completely debt-free. Note that the values from the column Present worth factor are used to compute the present value of the investment when you know its future value. Compound interest tables were used every day before the era of calculators, personal computers, spreadsheets, and unbelievable solutions provided by Omni Calculator 😂.

- Compound interest can also work against you when you have to pay it.

- As impressive an effect as compound interest has on savings goals, true progress also depends on making steady contributions.

- If you want to head back up to the calculator results area, you can click the link here.

As impressive an effect as compound interest has on savings goals, true progress also depends on making steady contributions. Let’s go back to the savings account example above and use the daily compound interest calculator to see the impact of regular contributions. $10,000 invested at a fixed 5% yearly interest rate, compounded yearly, will grow to $26,532.98 after 20 years. This means total interest of $16,532.98 anda return on investment of 165%. Fixed rates are rates that are set as a certain percentage for the life of the loan and will not change.

How Much Money Do I Need To Retire?

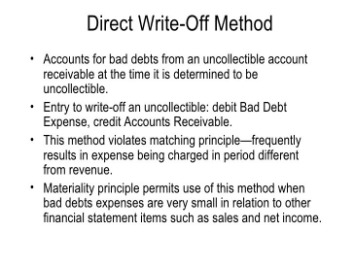

When paying interest, the borrower will mostly pay a percentage of the principal (the borrowed amount). The concept of interest can be categorized into simple interest or compound interest. When the returns you earn are invested in the market, those returns compound over time in the same way that interest compounds. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. The compound interest calculator lets you see how your money can grow using interest compounding. Within our compound interest calculator results section, you will see either a RoR or TWR figure appear for your calculation.

Usually, it is presented on an annual basis, which is known as the annual percentage yield (APY) or effective annual rate (EAR). In reality, investment returns will vary year to year and even day to day. In the short term, riskier investments such as stocks or stock mutual funds may lose value. But over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually.

This formula will show you what interest rate is needed to reach a particular final goal. If you plan to get $15,000 in 10 years, you need to know how much interest you will need to earn if you invest $5,000. In this example, the calculator will show you https://www.kelleysbookkeeping.com/ that (compounded monthly), you will need to find an investment that earns at least 11% per year. Compound interest can also work against you when you have to pay it. So you may pay interest on your interest if you carry a balance from month to month.

Fortunately, many online banks offer no-minimum, no-fee savings accounts. If an amount of $10,000 is deposited into a savings account at an annual interest rate of 3%, compounded monthly, the value of the investment after 10 years can be calculated as follows… Weekly interest calculator is an online personal finance assessment tool to calculate how much total interest and total repayment you should pay against your loan. This calculator is designed to calculate future payments for both simple and compound type interest rates and these two have been seperated by the radio button.

One can use it for any investment as long as it involves a fixed rate with compound interest in a reasonable range. Simply divide the number 72 by the annual rate of return to determine how many years it will take to double. Hence, if a two-year savings account containing $1,000 pays account for depreciation a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years. Ordinary interest on a regular bank savings account is typically paid for on an annual basis, with banks sending account holders a 1099-INT if they earn above some baseline level of around $10.

Compound interest is calculated on both the initial payment and the interest earned in previousperiods. Should you need any help with checking your calculations, please make use of our popular compound interestcalculator and daily compounding calculator. Looking back at our example, with simple interest (no compounding), your investment balanceat the end of the term would be $13,000, with $3,000 interest. With regular interest compounding, however, you would stand to gain an additional $493.54 on top. If you’re using Excel, Google Sheets or Numbers, you can copy and paste the following into your spreadsheet and adjust your figures for the first fourrows as you see fit. This example shows monthly compounding (12 compounds per year) with a 5% interest rate.

For loans such as mortgages and credit cards, compound interest is normally calculated monthly. In theory, you can calculate compound interest as frequently as you may want to calculate it (daily, weekly, monthly, etc.). In general, the interest on a savings account at a bank typically compounds daily, whereas a certificate of deposit (CD) might compound daily, monthly or semi-annually. For loans such as mortgages and credit cards, compound interest normally calculates monthly.

We compare personal finance solutions such as loans, saving accounts, credit cards, and more. Compound interest is truly one of the most risk-free ways to build wealth. When you have investments that generate a regular interest rate, you have the benefit of allowing that interest to compound over time. If you make regular contributions to the principal balance, the compounding effect will be even greater.

Compounding periods are the time intervals between when interest is added to the account. Interest can be compounded annually, semi-annually, quarterly, monthly, daily, continuously, or on any other basis. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total initial principal or amount of the loan is then subtracted from the resulting value. Daily compound interest is calculated using a version of the compound interest formula.To begin your calculation, take your daily interest rate and add 1 to it.

If you have any problems using our calculator tool, please contact us. I think it’s worth taking a moment to mention the monetary gain that interest compounding can offer. Lorien is the Country Manager for Financer US and has a strong https://www.personal-accounting.org/gross-sales-what-it-is-how-to-calculate-it-and/ background in finance and digital marketing. You can see an example of how the compound interest effect works on a $1,000 investment below. Compound interest allows you to earn interest on the interest you earned in previous years.